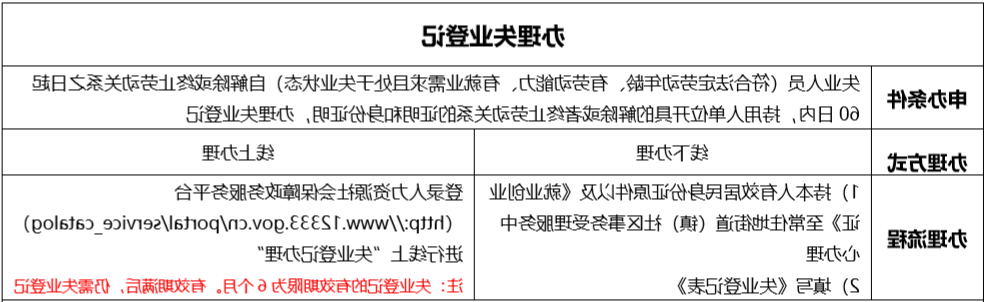

Employee Employment and Entrepreneurship Certificate Application Guide (Shanghai domicile only)

First time application conditions:

① All kinds of new growth labor force such as the city's household registration, previous graduates

② Graduates who need to enjoy the tax support policy for self-employment

③ Municipal agriculture with Labor Manual or Employment and Unemployment Registration Certificate Persons whose household registration has changed to non-agricultural household registration

④ Other workers who meet the provisions of the Municipal Human Resources and Social Security Bureau

Reissue or replacementEligibility requirements:

① Workers whose Employment and Entrepreneurship Certificates are lost or damaged and need to be replaced

② Persons who have held the "Employment and Entrepreneurship Certificate" issued by other provinces and cities have registered Workers who need to renew their permits to move into the city

③ Employers in accordance with the "on the City to support and promote employment relevant Notice on the specific Implementation of Preferential Tax Policies Spirit Enjoy preferential tax policies, ask to change the "Employment and Entrepreneurship Certificate"

Application materials:

① Original valid ID card or social security card

② Original and photocopy of household registration book or household registration certificate (copy of the first page of household registration book and my page)

③ Two inch ID photo of myself2张

④ Previous students who did not continue their studies should present their graduation certificates;College graduates in the graduation year need to present student ID and graduate recommendation form

⑤ In case of special circumstances, other relevant supporting materials shall be submitted

⑥ I need to fill in the Personal Basic Information Form and Labor Registration Form

⑦ If it is handled in the place of residence, it is necessary to show the Application Form for Residence Registration of the separated persons of the City's household Registration (Return receipt).

Handling place: Public employment service agencies in the streets and towns of the place of residence or residence

Warm reminder:For employment and unemployment registration certificate, it is recommended that employees first confirm with the handling agency, and may handle the exit and stop insurance procedures for the units that need to pay the staff Only after handling。Automatic failure involving:

Having reached the statutory retirement age; Enjoying basic old-age insurance benefits; Emigrating abroad; Completely losing the ability to work; Dead; Other circumstances that should be invalid according to laws and regulations。

Reference website :

http://rsj.sh.gov.cn/tmsztc_17502/20200617/t0035_1379453.html

http://rsj.sh.gov.cn/tmsztc_17502/20200617/t0035_1379452.html

If in doubt, please contact customer service 400 630 6666

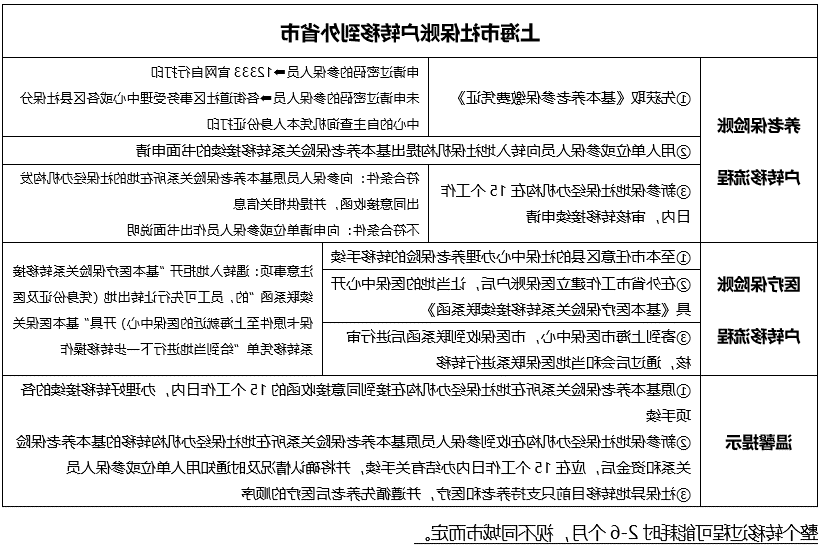

Employee "remote pension transfer" handling guide

Social security accounts from other provinces and cities are transferred to Shanghai

Application requirements:

The employee can transfer the pension insurance paid in other places only after establishing the pension insurance account in Shanghai and paying the pension insurance normally

Handling place:

At present, the social security center of the unit social security payment area

Handling requirements:

In person: ① The identity card of the original unit and social security card ② The Basic Endowment Insurance Payment Certificate issued by the social security agency of the original insured place ③ Fill in the Basic Endowment insurance relationship transfer and continuation Application Form to the insured district social security center counter for transfer and continuation procedures

Entrusted to:① One copy of the employee's social security card and ID card ② The Basic Endowment Insurance payment Certificate issued by the social security agency of the original insured place ③ Fill in the Basic Endowment Insurance relationship transfer and continuation Application Form ④ the original ID card of the unit manager

Online application:

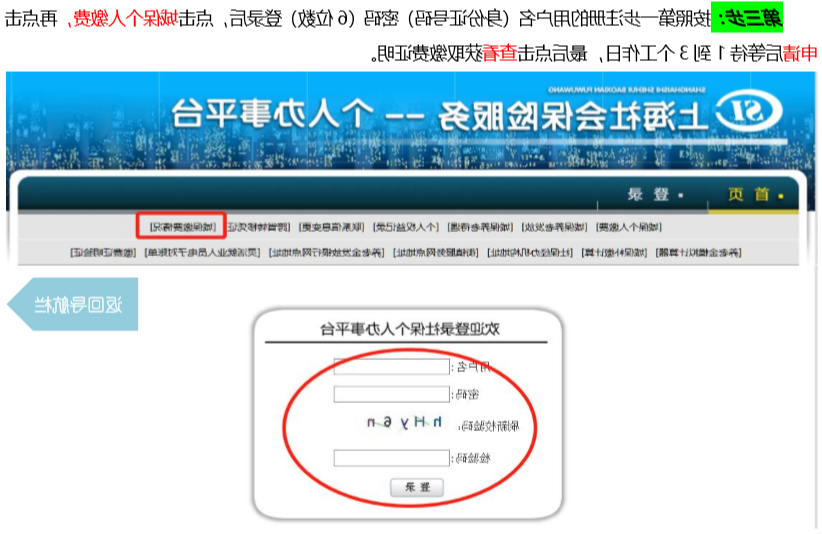

Register and log in to the national social insurance public service platform(si.12333.gov.① After login, click "Relationship Transfer" in the upper function bar to enter the social security relationship transfer interface;② Click on the "Social security transfer application to the opening area of inquiry" to check whether the transfer area has opened online application business;③ Click "Social security transfer application" ④ fill in my basic information and transfer information according to the prompts, click submit the application after filling in, wait for the audit result ⑤ after the audit meets the transfer conditions, according to the system prompts for the follow-up transfer process。

Processing time:

The Social Security Center will send a transfer notice to the local social security institution after the review, and the local institution shall transfer the funds and payment details to the Shanghai Social Security Normal after receiving it The closing period is in4-6个月。

Note:

① Social security accounts transferred from other provinces and cities to some parts of Shanghai do not support online processing;

② Social security remote transfer currently only supports pension and medical care, andFollow the order of old-age care first and medical care later;

③ If the employee's medical treatment relationship is transferred to other provinces and cities and is transferred back to Shanghai by the unit, he or she can apply for the transfer of medical treatment relationship to the neighboring district and county medical insurance center with his or her ID card, Social Security Card or medical insurance card and the relevant certificate issued by the unit Before the formalities of transferring the medical relationship back to this city, the procedures for reimbursement of sporadic medical expenses incurred in other provinces and cities shall be completed。

Reference website:

http://rsj.sh.gov.cn/tmsztc_17502/20200617/t0035_1379378.html

If in doubt, please contact customer service 400 630 6666

Employee "transfer of accumulation fund in different places" handling guide

The provident fund accounts of other provinces and cities are transferred to Shanghai

Application requirements:

After an employee has set up a housing provident fund account in the city and has contributed to the housing provident fund, he or she may apply to the Shanghai Municipal Provident Fund Administration Center for a residence in a foreign province or city The housing accumulation fund is transferred to the city;Employees need to confirm with the original payment city whether the fund can be transferred out。

Handling place:

Shanghai provident fund management center district management department

Handling requirements:

In person: ① Valid identity document of the applicant;The completed Application Form for the Transfer and continuation of the Shanghai Housing Provident Fund in different places is in duplicate。

Entrusted unit: (multiple employees of the same unit simultaneously handle the transfer and continuation of housing provident fund in different places, Can entrust the unit manager on behalf of the application) ① Completed "Shanghai Centralized Housing Provident Fund transfer Application Letter"; ② Completed Application Form for the Transfer and Continuation of Shanghai Housing Provident Fund (in duplicate for each employee); ③ A copy of the employee's valid ID card and the valid ID card of the unit's manager件。

Online application:

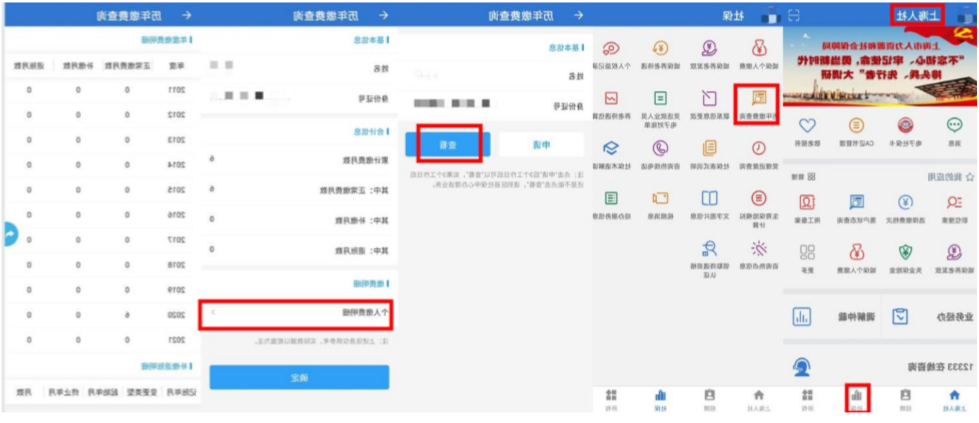

Employees who set up a housing provident fund account in this Municipality and steadily pay into the housing provident fund for more than half a year

Signed an online service agreement。 Application channel: Shanghai Housing Provident Fund official websitewww.shgjj.com & Shanghai Provident Fund wechat public number&With the bid public cloud APP

Note:

Transfer to Shanghai in the form of payment by the current unit;② Employees are foreigners and Hong Kong, Macao, Taiwan working in Shanghai, currently can not apply online for personal housing provident fund transfer to the city

Reference website:

http://www.shgjj.com/html/201703gjjydzy/95079.html

http://www.shgjj.com/html/xxgk/qtgz/ywznjc/ywznzhzy/203073.html#a1

If in doubt, please contact customer service 400 630 6666

Employee "Party member relationship transfer" handling guide

Transfer conditions:

I. Meet the requirements of the client company transferred to the organizational relationship as follows:

1, customer staff size is not less than 500 people;

2, the number of existing party members of the customer is not less than 10;

2. Meet the requirements of party members transferred to organizational relations as follows:

1. Party members shall establish labor relations with the client's Shanghai company;

2. The party member's long-term work place, residence and social security payment place are in Shanghai;

3, if the party member is not registered in Shanghai,则需提供长期在上海工作和居住的证明文件(以下任选其一): 1)党员居住地居委会开具的连续超过6个月的Residence permit明(盖章);2)党员在上海的租房合同复印件; 3)党员提供其Residence permit复Printed copy (including validity period) or copy of residence permit points notice。

4. Probationary Party members: from the beginning of the proposed transfer to the foreign company's Deke Party Committee, to the expiration of the preparatory period, less than 3 months, no longer accept the party organization relationship;

5. If a party member is applying for a Shanghai hukou, he/she can apply for transfer only after completing the registration procedures, and provide the latest information of the Party committee of the registered place;

6. Party members who apply online to transfer to the Party membership organization must prepare a copy of the Application for Party Membership (9-11 pages) and a copy of the Review of Archival Materials in advance.。 See the following guidelines for obtaining the above materials:

oneThe above party member materials should be stored in the personnel file, please confirm the location of the personnel file custodian institution before checking: 1.1 Shanghai registered Party members whose ID number is "beginning with 310" : Please consult the place of registrationDistrict and county employment promotion center or community affairs Processing center; 1.2. Shanghai household registration with ID number "not beginning with 310" : Please consult the talent service center, the employment guidance center for college graduates, and the community affairs acceptance center of the street where your household registration is located when you apply for Shanghai household registration;(Example: fresh graduates of Shanghai domicile,File in the university graduate employment guidance center;Residence permit transferred to Shanghai household registration,File in the city/district talent service center or the residence of the street community affairs acceptance center) 1.3 非Shanghai domicile:请咨询您户口所在地档案保管机构、毕业院校或发展入党的党组织; 1.4 Note: If your last employer is a state-owned enterprise, university or institution, your personnel files may be kept by your last employer;

2.Contact fileCase custodian, obtain the Application for Party Membership (9-11 pages) photocopies and "Information Sheet on Access to Archival Materials" : 2.1 上家党组织在上海:如有需要,党员可在转入党员组织关系申请界面点击“申请档案调阅 介绍信”线上申请开阅档涵,外企德科上海公司党委生成机打介绍信,盖章后寄送给党员 本人; 2.Party members in other places: the party members themselves contact the Party organizations, the Party organizations contact the archival custodians, copy the Application Form for Party membership (pages 9-11), download and fill in the Information Form for Archival Materials (see the end of the document), and go to the archival custodians to inquire and affix the official seal。

3.Upload the copy of the Application for Party Membership (9-11 pages) and the archive materialsThe original copy of the Material Inspection Form and the documents shall bePDF format, the file is less than 2M;

4.Relevant precautions:Please first prepare the above party member materials, and then contact the home party organization to issue a letter of introduction, so as not to cause the letter of introduction to expire;If the filing institution is unable to provide the application form 9-11 页复印件的,请存档机构在档案调阅情况表中写 明入党和转正的时间,具体到XX年XX 月XX日,并在上传《欧洲杯买球网》的栏目里,也上传《欧洲杯买球》; 核查档案材料齐全方可获批转入;If there is a lack of file materials of Party members, the last party organization should cooperate with the party members to supplement the complete materials, after the inspection is correct, can be transferred。

Transfer process:

1) A letter of introduction issued by a party member's family organization (organizational relationship Shanghai,Need to transfer out in advance in CCPM system) 2) Scan the QR code on the right side of wechat,Enter the organizational relationship transfer application process 3) Fill in the personal information accurately,Upload the letter of introduction and proof of residence in Shanghai 4) the background review is passed 5) The original letter of introduction is sent by the party member 6) The party member is enrolled in the party branch 7) The Party member contacts the party branch secretary for registration。

Warm reminder:

Party members shall apply for the transfer of organizational relations with a letter of introduction within the validity period, and Party members who have not been transferred to a regular position within the one-year reserve period will not be accepted。

If in doubt, please contact customer service 400 630 6666

Employee "Shanghai New Social Security Card" handling guide

Social Security card bank acceptance outlets:http://www.962222.net/pages/sbk/sbkfw.html

Social Security card application website:http://www.962222.net/index.html

Community Affairs Reception Service Centre Enquiry:http://sqggfw.mzj.sh.gov.cn/MZJ/ServiceDistrict.aspx

If in doubt, please contact customer service 400 630 6666

Employee "Individual Provident fund account transfer" handling guide

Reason for handling

Employees have paid the provident fund in different places, and now Shanghai needs to transfer the provident fund paid in different places to Shanghai

Handling agency

1. Remote provident fund handling agencies

2. Shanghai certification agency: Shanghai Provident Fund Management Center Address: No. 725 Fuzhou Road, 4th floorClick to view the provident fund management center address of each district

Handling conditions

1. Off-site policy allows transfer out

2. Shanghai has a regular provident fund account

Handling process

1. Employees confirm whether the provident fund account status in Shanghai is normal and is being paid

2. Bring my original ID card to Shanghai Provident Fund Management Center to issue a certificate of payment

3. The certificate will be submitted to the institution in the other place

4. Confirm the processing time of the local processing agency

Deadline for handling

Employees can go to the unit Provident Fund payment bank after 30 working days to check, or FESCO Adecco can confirm on their behalf

If in doubt, please contact customer service at 400 630 6666

Employee "Social Security into business" handling guide

Employee "Recruitment Procedures" handling guide

Retirement social security provident fund shutdown time

The following operations are local services and do not involve transfer to other cities

Ø post-employmentLeave within 1-3 working days

Ø File withdrawal shall be completed within 15 working days after the termination of the work, and the file shall be returned to the employee's domicile 2-3周

Ø After the payment of the last month's provident fund, the employee account will be transferred to the provident fund storage office (or next) after the provident fund is deposited.

Employee "Retirement Business" handling guide

Retirement shall be applied for by the unit for the employee

Application requirements:

Male or above60 years old, women at least 50 years old, women engaged in management, technical positions at least 55 years old [normal retirement age, but for individual provinces (such as Qinghai), the regulations will be different]

The payment period expires15 years (including deemed payment period)

Application materials:

Copy of ID card stamped with official seal

"Application Review Form for Receiving One-time Family Planning Incentive Fee for Old Age" (issued by the Family Planning Office of the street where the household registration is located)

"Pension Application Form" and "Pension Method Confirmation Form" shall be stamped with official seal

女性Those who retire between the ages of 50 and 55 will also need to provide a termination agreement

Handling process:

In the month when the employee reaches the statutory retirement age, he/she shall submit the materials to the social insurance center for review, handle the pension collection procedures, and start to pay the pension the following month

Rules for early retirement:

Guide to handling Unemployment benefits for employees

Unemployment benefit registration

Unemployment benefit

Employee "Social Security transfer to other places" handling guide

Employee "Provident fund transfer to other places" handling guide

Employee "Party member relationship transfer out" handling guide

Handling guide of employee "Withdrawal of account cancellation for Employees with domicile in different Places"

Scope of application

Non-shanghai employees who move out of the city and have established labor relations with other provinces and cities and set up housing provident fund accounts。

Handling place

Construction bank housing provident fund business outlets。

Handling requirements:

1.Original and copy of identification materials:

(1) the identity card provided by the person;

(2) Entrusted to:

① If the trustee is the spouse or direct blood relative of the truster, it is necessary to provide the identity card of the truster and the trustee, household registration book or marriage certificate, household registration certificate issued by the public security organ, etc., which can prove the relationship between the truster and the trustee, and the power of attorney issued by the truster;

② If the trustee is not the spouse or direct blood relative of the truster, it is necessary to provide the identity card of the truster and the trustee, and the power of attorney notarized by the notary office。

2.Original and photocopy of the reasons for account transfer:

(1) Household registration or household registration certificate of other provinces and cities;

(2) Proof of termination of labor relations with the municipal unit;

(3) The relevant certificate of the established housing provident fund account issued by the urban housing provident Fund management center where the labor relationship is established (need to include personal and unit housing provident fund account information and receive housing in the city

Provident fund account funds transfer account name, account number, bank, etc.)。

3.Other supporting materials:

When individuals obtain the following certification materials, they should provide the above identification materials and account transfer reasons to the relevant units or departments。

(1) The "Shanghai Housing Provident Fund Withdrawal Certificate" issued by the providing unit of the housing provident fund account;

(2) Housing provident fund account in“Shanghai provident fund Management center housing provident fund centralized sealed special accounts”Provide the "Shanghai Housing Provident Fund Withdrawal Certificate" issued by the business network of Shanghai Provident Fund Management Center and the "Application for Housing provident fund withdrawal Audit Form for households entering the tube and sealing up"。

Handling process

Individuals provide essential materials——Construction bank housing provident fund business outlets。

Processing time limit

No more than 3 working days if the formalities are complete。

Employee "apply for unemployment insurance benefits" handling guide

Employee "Medical relationship transfer" handling guide

Application conditions:

Retirees and urban and rural residents who participate in the municipal basic medical insurance for employees(hereinafter referred to as resident security personnel), need to settle in other provinces and cities or from other provinces and cities to settle back in this city

Employees who participate in the basic medical insurance for employees of this Municipality, whose place of employment is in other provinces or cities or who are transferred back to this Municipality from other provinces or cities

Handling requirements:

Medical relationship transfer out:Valid ID of the insured person;The insured's Medicare or Social Security card;When the serving personnel handle the transfer of medical treatment relationshipAt the same time, it is necessary to provide the certificate of the unit's assignment;If there is an agent, the agent should also provide a valid identity document。

Doctor relationship return:Valid ID of the insured person;The insured's Medicare or Social Security card;If there is an agent, the agent should also provide a valid identity document。

Way of handling:

Insured personnel or agents to provide relevant materials to the city street(town) community affairs acceptance center, the city's street (town) community affairs acceptance center only handles the transfer of retirees' medical relations and the transfer of medical relations of residents。

Insured personnel or agents to provide relevant materials to the city's district medical insurance affairs center for processing。

Retirees, residents provide relevant materials through Shanghai"One Netcom Office", "with the application" platform for medical relationship transfer procedures。

Note:

Handling the transfer of medical treatment relationshipIn principle, it cannot be handled again within 6 months。However, persons with medical relations outside the provinces and cities, within 6 months of a serious illness or serious disease in hospital, must return to the city's medical institutions for treatment, can be issued by the city's designated medical institutions of serious illness or hospital certificates, for the transfer of medical relations。

An employee who has been transferred back to this city due to his work shall be found inYou can also apply for the transfer of medical treatment within 6 months。

Retirees who handle the transfer procedures for medical treatment and need to first complete the reimbursement of medical expenses in different places or the liquidation of account funds can only be insured in the district Insurance affairs center。

Employee "Sporadic Reimbursement of Medical expenses" handling guide

Scope of reimbursement:

Medical expenses for emergencies in designated medical institutions of foreign provinces and cities under medical insurance;

Medical expenses incurred in the city due to pre-hospital first aid, outpatient emergency medical expenses incurred during the period of reporting loss or loss of medical insurance card ;

The outpatient and emergency medical expenses, the hospitalization and observation expenses in the emergency observation room, and the hospitalization medical expenses incurred by the insured personnel transferred to other provinces and cities living in other provinces and cities。

Bill requirements:

A receipt of medical expenses issued by a designated medical institution, and no medical insurance has been settled;

In general, the insured shall apply for reimbursement to the medical insurance agency within six months of the receipt issued by the medical institution;

The medical expenses incurred are covered by the medical insurance。

Handling requirements:

A valid ID of the insured person;

Health insurance or social security card and debit card of the insured;

Special receipt for emergency medical expenses(a detailed list is required), relevant medical history and copies (such as examinations, laboratory tests, image reports, Chinese medicine prescriptions, etc.);

Special receipt for outpatient medical expenses(A detailed list is required), "Medical Insurance Card damage Notification Form", relevant medical history and copies (such as examination, laboratory tests, image reports, traditional Chinese medicine prescriptions, etc.);

Special receipt for medical expenses in the emergency observation room and discharge(Observation) Summary, list of medical expenses for hospitalization in the emergency observation room and photocopy, relevant medical history data and photocopy;

Special receipt for inpatient medical expenses, list of inpatient medical expenses and photocopies, discharge summary and photocopies, relevant medical history and photocopies;

Other causeIn special circumstances, the medical insurance staff requires the party to supplement the relevant materials;

If it is entrusted to others, it should also provide a valid identity document of the agent。

Way of handling:

The insured person or agent shall provide relevant materials to the city street(town) community affairs processing center;

The insured person or agent shall provide relevant materials to the medical insurance affairs center in each district of the city;

Participants provide relevant materials through ShanghaiMedical expenses reimbursement "one thing" in the theme of "One thing" in the "One thing" platform。

Note:

When applying for sporadic reimbursement of basic medical expenses, the bank card information must be the debit card of the person concerned。

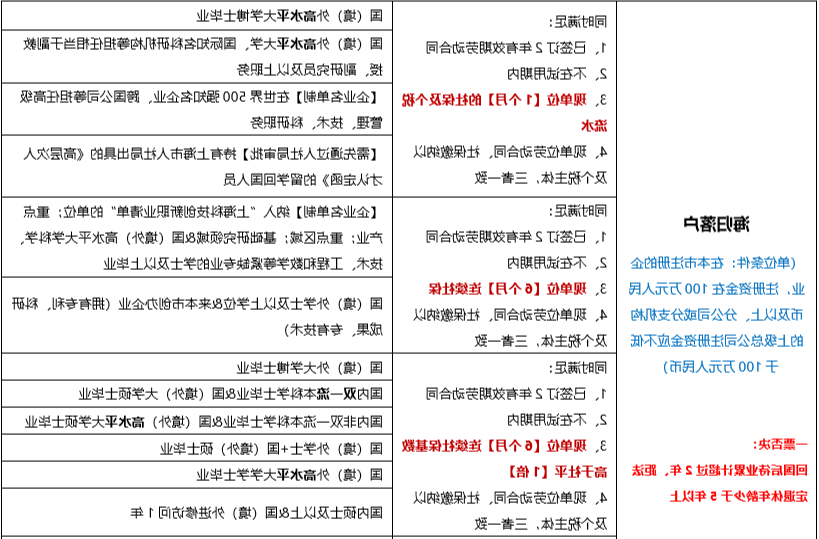

Employee "maternity insurance application" handling guide

Maternity insurance benefits composition:

Maternity insurance benefits include the People's Republic of China Social Insurance Law, Shanghai Urban maternity insurance Measures stipulated in the birth Living allowance and maternity medical expenses allowance are paid from the basic medical insurance fund for employees

Maternity insurance benefits paid :(Effective from July 1, 2016 for 5 years)

Female workers who participate in the maternity insurance of this Municipality and meet the conditions stipulated by the laws and regulations of the State and this municipality may give birth or have an abortion according to the regulations Directed the municipal social insurance agencies to apply for maternity insurance benefits;

The employer shall pay the accumulated maternity insurance premium for the female employee in the month of childbirth or abortionIf the maternity insurance premium has been paid for 12 months or for nine consecutive months, the maternity living allowance shall be paid in full by the maternity insurance fund;

The employer is dissatisfied with the accumulation of maternity insurance premiums paid by female workers in the month of childbirth and abortionIf the maternity insurance premium has been paid continuously for less than 9 months for 12 months, the maternity living allowance shall be paid by the maternity insurance fund according to the proportion obtained after the number of paid months ÷12, and the remaining part shall be paid by the employer where the female worker works in the month of childbirth or abortion.The employing unit shall pay the accumulated fees for the employee满After 12 months or 9 months of continuous payment, you can apply to the social security agency to allocate the fees that have been paid in advance。

Handling place:

Every street, town (township) community affairs reception service center

Application requirements:

Family planning (If it meets the family planning policy or the conditions for having a second child stipulated by the State, it is a family planning。(The production is set up according to the regulations Medical institutions of the department of obstetrics and gynecology, childbirth or abortion (including natural abortion and induced abortion), women who fall under one of the following circumstances, may be prescribed To apply for maternity living allowance and maternity medical expenses subsidy: 1) Employed women with urban household registration in this municipality, whose units have participated in urban social insurance in this municipality and have established personal accounts in accordance with regulations; 2) Unemployed women with urban household registration in this municipality participate in urban social insurance in this municipality according to regulations and establish personal accounts according to regulations; 3) Freelancers with urban registration in the city, informal employment labor organization personnel, participate in the city's urban social insurance and establish a person in accordance with the regulationsAccount's; 4) Employed women who do not have urban household registration in this municipality have established labor relations with the employing units participating in urban social insurance in this municipality and have established individual accounts in accordance with regulations; 5) The labor contract employees with municipal household registration recruited by foreign-invested enterprises and private enterprises participating in the rural social endowment insurance of this Municipality shall pay the old-age insurance premium and medical insurance premium and establish individual accounts according to the proportion of payment prescribed by the urban social insurance of this municipality; 6) The individual industrial and commercial households and their helpers who participate in the municipal rural social endowment insurance and have municipal household registration pay the old-age insurance premium and medical insurance premium and establish personal accounts according to the payment ratio prescribed by the municipal urban social insurance。

Handling requirements:

1) Original resident identity card; 2) Family Planning Review Form of Shanghai Municipality's Application for Maternity Insurance Benefits or Certificate of Family Planning Status of Shanghai Municipality's Application for Maternity Insurance Benefits issued by the street town (township) level government; 3) Fertility medical materials: those who gave birth in the city,The original Reproductive Medicine Certificate issued by a medical institution is required;Born in other provinces and cities,A discharge summary (or medical record) issued by a qualified medical institution indicating the maternity situation (dystocia, vaginal birth or abortion) and a copy of the baby's birth Medical certificate;Born abroad or in Hong Kong, Macao or Taiwan,Copies of medical records and other materials issued by local medical institutions indicating the maternity situation (dystocia, vaginal birth or abortion) are required; 4) Application Form for Maternity Insurance Benefits (copy of materials)Signed by myself。In case of entrustment, an authorization signed by the principal shall be carried The original copy of the book and the resident identity card of the trustee and the copies of the front and back。If the materials are not in Chinese, a Chinese translation with the seal of the translation agency shall be provided.)。

Employee "Industrial Injury Insurance" handling guide

Industrial injury identification:

Injury due to work-related accidents during working hours and in the workplace;

In the workplace before and after working hours, while engaged in preparatory or finishing work related to work, he is injured by an accident;

During working hours and in the workplace, accidental injuries such as violence are suffered due to the performance of work duties;

Occupational ill

While out for work, he is injured or his whereabouts are unknown due to work accidents

Being injured by a motor vehicle accident while going to and from work;

Other circumstances that shall be recognized as work-related injuries according to laws and administrative regulations

As injury:

During working hours and at work, sudden illness or death inDied within 48 hours after rescue failed;

Injured in the activities of safeguarding national interests and public interests such as rescue and disaster relief;

The employee formerly served in the army, is disabled due to war or work-related injuries, has obtained a revolutionary disabled soldier's certificate, and his old injury recurs after he returns to the employing unit Employees who fall under items (1) and (2) of the preceding paragraph shall enjoy work-related injury insurance benefits in accordance with the relevant provisions of these Measures;The employees are In the case of item (3) of the preceding paragraph, workers shall enjoy work-related injury insurance benefits other than one-time disability compensation in accordance with the relevant provisions of these measures。

Time limit for acceptance:

The employing unit shall start from the date of the accident injuryWithin 30 days, apply to the district and county labor security administrative department for identification of work-related injuries。If the employer fails to file an application for recognition of industrial injury within the prescribed time limit, the employee or his immediate family or the trade union organization may file an application for recognition of industrial injury with the district and county labor security administrative department within one year from the date of the accident。

Application materials:

Application form for identification of work-related injury;

Documents certifying the existence of labor relations (including de facto labor relations) with the employer;

The medical diagnosis certificate or occupational disease diagnosis certificate (or occupational disease diagnosis certificate) application form for industrial injury recognition shall include the time, place, cause of the accident and the basic information such as the degree of injury of the employee An application for recognition of a work-related injury, in addition to the materials required in the preceding paragraph of this article, may also be submitted to the employer, the relevant administrative organ or the people's court Available supporting materials。

Work-related injury treatment:

Treatment of industrial injury stage, the unit pays industrial injury treatment:Pay benefits during downtime Generally not more than12 months, special or serious, after appraisal can be extended not more than 12 months of the original salary and welfare benefits unchanged; Life nursing Those who need nursing care during the work stoppage period shall be responsible for the work unit。

At the stage of treatment of industrial injury, work-related injury benefits paid by the industrial injury insurance fund: Medical expenses for treatment of work-related injuries;Food allowance;The newspaper agrees to the transportation, accommodation and lodging expenses for medical treatment outside the coordinating area;Rehabilitation costs for treatment of work-related injuries

Work injury treatment paid by the unit after the assessment of working ability: disability allowance for Grade 5 and 6 disabled employees;One-off disability employment subsidy (The specific standards shall be regulated by the people's governments of provinces and municipalities and autonomous regionsFixed, calculated on the basis of social wage) Work-related injury benefits paid by the industrial injury insurance fund after the assessment of working ability: the cost of configuring assistive devices;Living care expenses that are unable to take care of themselves (confirmed by the labor ability Evaluation Committee);Disability allowance for Level I to Level IV work-related injuries;One-off disability benefit (based on my salary);One-off medical benefits for work-related injuries (the specific standards shall be prescribed by the people's governments of provinces and municipalities and autonomous regions, and shall be calculated on the basis of social wages) 。

After the working ability evaluation, the treatment of workers who die: Funeral Benefits:6 months of the average monthly wages of employees in the previous year;Dependent relatives pension: a certain percentage of the employee's own salary is paid to the spouse every month40% and 30% per month for each other relative;One-off death subsidy: the per capita disposable income of urban residents nationwide in the previous year20倍。

Labor ability evaluation:

If an employee is injured at work and has a disability that affects his working ability after his injury condition is relatively stable after treatment, he shall be evaluated for his working ability。Waiting capacity After the appraisal conclusion is reached, the compensation standard for industrial injuries shall be determined。

The evaluation of labor ability refers to the grade evaluation of the degree of labor dysfunction and the degree of self-care disorder。Its labor dysfunction is divided into ten disability levels, level 1 is the most severe, level 10 is the lightest。

Labor capacity evaluation expenses:

The appraisal fee for the working ability of the employee of the employer who has participated in the industrial injury insurance shall be paid by the social insurance agency according to the provincial price, finance and labor insurance Standard payment required by the department。

If the application for initial appraisal is made by the injured worker or his immediate family members, the appraisal fee shall be made by the worker or his immediate family members at the time of application Pay in advance, and then apply to the insurance institution or the employer for treatment。

Occupational disease:

Occupational disease refers to the exposure of workers of enterprises, public institutions, individual economic organizations and other employers to dust, radioactive substances and chemicals during occupational activities Diseases caused by other toxic and harmful substances。The worker may undertake the occupational-disease-diagnosis medical and health equipment in the place where the employer is located according to law Conduct occupational disease diagnosis。If it is diagnosed or assessed as an occupational disease according to the Law on the Prevention and Control of Occupational Diseases, the employer shall be diagnosed and assessed as an occupational disease As ofWithin 30 days, an application for industrial injury recognition shall be submitted to the social insurance administrative department of the overall planning area。

Note:

The above requirements and standards for industrial injury operations, when the accident injury has not been determined as an industrial injury, are called accidents

Employee "Provident fund loan and purchase policy" handling guide

Personal housing loan application

Application conditions:

1、The loan applicant and the joint loan applicant are the workers who normally pay the housing accumulation fund, including the individual workers who pay the housing accumulation fund in this city Merchants and their employees, part-time employees and other flexible employment personnel (hereinafter referred to as voluntary contributors);

2、Employees who normally deposit housing provident fund in other provinces and cities should first provide and review the "Housing provident fund deposit Certificate for employees with loans in other places. Ming ", and meet the relevant policy requirements of off-site loans;

3、Meet the conditions stipulated by the national and municipal real estate control policies;

4、Having full capacity for civil conduct;

5、Already over18 years of age and under the legal retirement age (legal retirement age: 60 for men and 55 for women); 6、The provident fund account is unique and has not been frozen, and the current continuous full contribution to the housing provident fund has reachedSet time limit (6 months), and there is no ongoing housing provident fund withdrawal agreement (including but not limited to housing provident fund withdrawal and loan repayment agreement, housing provident fund withdrawal and rent payment agreement and other housing consumption withdrawal agreement);

7、Have good credit history and repayment willingness;

8、Have a stable and legal source of economic income and the ability to repay the principal and interest of the loan, and the borrower's family or co-borrower's family does not Have outstanding housing provident fund debts or other debts that may affect the repayment of provident fund loans;

9、The family of the loan applicant and the co-loan applicant have no or only one provident fund loan history;

10、The loan applicant must be the owner of the owner-occupied housing with ownership in the city and be able to provide the relevant contract or proof of purchase 文件、Proof of identity, proof of down payment and other materials that meet the requirements;

11、Has paid down payment funds not less than the prescribed proportion;

12, can provide the city provident fund center approved by the way of guarantee;

13, the loan applicant's share of the mortgaged property is not lower than the average share of all property owners;

14. The applicant for joint loan shall be the spouse, parents and children of the applicant;

15, the joint loan applicant shall bear the joint repayment responsibility of the provident fund loan;

16, the loan applicant and co-loan applicant meet the other conditions stipulated by the municipal Provident Fund Management Committee or the municipal Provident fund center。

Handling place:

1、 The pure provident fund loan shall be accepted by the business department of Shanghai Housing Real Estate Financing Guarantee Co., LTD.;

2、 The provident fund portfolio loans shall be accepted by the branches of the municipal provident fund loan entrusted bank。

Handling process:

Loan reservation➡Loan acceptance (real estate inquiries, credit inquiries)➡Loan approval➡Sign the provident fund loan contract➡Handle the transfer and transfer Real guarantee➡Bank loan

Time limit for processing:

The loan application documents are complete and the approval time limit is not exceeded10 working days;If the loan conditions are met, the loan time limit shall not exceed 5 working days after the loan is approved

Personal housing loan review

Application conditions:

Loan applicants or joint loan applicants due to job changes and other reasons caused by omission, underpayment and supplementary payment of housing provident fund, resulting in failure to meet six consecutive months If the deposit is abnormal or caused by other special circumstances, the loan applicant can apply for reconsideration at the same time as applying for the provident fund loan。

Handling place:

1. The pure provident fund loan shall be accepted by the business department of Shanghai Housing Real Estate Financing Guarantee Co., LTD.;

2, provident fund portfolio loans are accepted by the municipal provident fund loan entrusted bank branches;

3. The reconsideration application network and the loan acceptance network shall be the same network。

Handling requirements:

1. Application materials required for loan。

2. Deposit the application materials for reconsideration for six consecutive months: (1) the original statement of the supplementary unit,Prove the reasons for missing payment and the situation of paying in arrears,And stamped with official seal or personnel department seal;If the applicant unit entrusts the third party to pay the housing provident fund on behalf of the applicant,Should indicate the entrusted fund payment matters and the name of the entrusted third party unit;(2) The original social security payment details issued by the social security institution,Need to match the provident fund payment;(3) The original and photocopy of the labor contract signed by the applicant and the housing provident fund supplementary payment unit that can prove the labor relationship;(4) If the applicant transfers the provident fund from other provinces and cities to Shanghai and the payment is not continuous for 6 months,Only the original and photocopy of the valid proof of the housing provident fund payment before and after the transfer。 3, because of other specialIf the circumstances require reconsideration, other relevant materials shall be provided。

Housing provident fund remote personal housing loans

Housing provident fund individual housing loan in different places (hereinafter referred to as the loan in different places) refers to the employee who has paid the housing provident fund in other provinces and cities (hereinafter referred to as the paid-in post in other provinces and cities) The housing provident fund individual housing loan (hereinafter referred to as provident fund loan) applied for in this City when purchasing self-occupied housing in this City, or the housing reserve deposited in this City Jin's employees (hereinafter referred to as the city's paid-in employees) apply for provident fund loans in foreign provinces and cities when purchasing self-occupied housing。

Application conditions for paid-in workers from other provinces and cities:

Workers from other provinces and cities who purchase the first set of housing or the second set of improved housing in this city, and meet the conditions of other provident fund loans in this city, can Apply for a provident Fund loan in the city:

(A) deposited in the name of the employee family has no provident fund loan record in the country and no housing in the city, identified as the purchase of the first housing;(2) The employee's family has a provident fund loan record in the country or has a house in the city or purchased a second set of improved housing Is deemed to be the purchase of a second set of improved housing。 The application of provident fund loans for paid-in employees from other provinces and cities with municipal household registration shall be given key support。 Employees from other provinces and cities who have two provident fund loan records in the country or who purchase a second set of non-improved or above housing in this city will not be accepted Manage provident fund loan applications。

The city's paid-in employee application conditions:

Employees in the city need to apply for provident fund loans in other provinces and cities, and they and their spouses have not used provident fund loans or first provident fund loans in the city If the payment has been settled, it may apply to the district management department of the Municipal provident fund Center for issuing a certificate of deposit and use。

Note:

These measures are fromEffective from September 1, 2020, valid for five years。

Provident fund purchase

Non-residents of the city also need to meet the application conditions for housing in the city to apply for provident fund loans

Application requirements:

① The purchaser must be married;

② The purchasing families do not have commercial housing in Shanghai;

③ I or my spouse have been in Shanghai recentlySocial security tax receipts accumulated for 60 months within 63 months or individual income tax receipts accumulated for 60 months within the latest 63 months。

Employee "Provident fund loan and purchase policy" handling guide

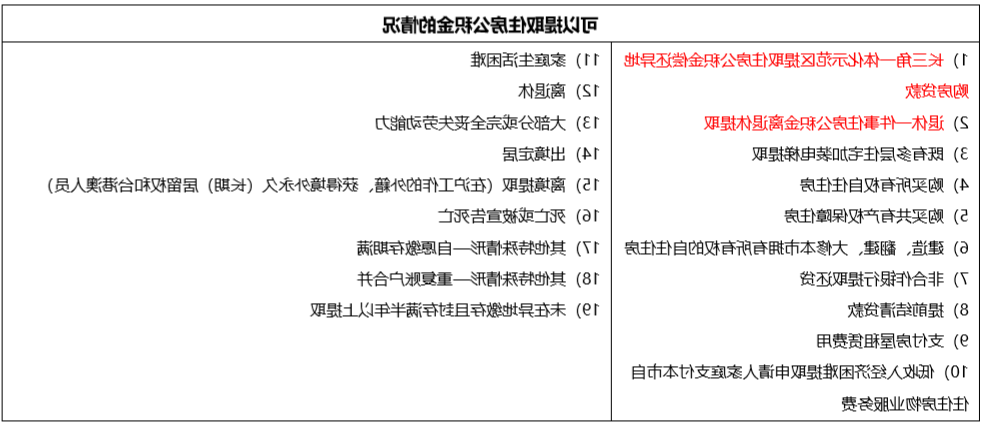

Circumstances under which housing provident fund can be withdrawn:

1)长三角一体化示范区提取Housing accumulation fund偿还异地 购房贷款 2)退休一件事Housing accumulation fund离退休提取 3)既有多层住宅加装电梯提取 4)购买所有权自住住房 5)购买共有产权保障住房 6)建造、翻建、大修本市拥有所有权的自住住房 7)非合作银行提取还贷 8)提前结清贷款 9)支付房屋租赁费用 10)低收入经济困难提取申请人家庭支付本市自 住住房物业服务费 11)家庭生活困难 12)离退休 13)大部分或完全丧失劳动能力 14)出境定居 15)离境提取(在沪工作的外籍、获得境外永久(长期)居留权和台港澳人员) 16)死亡或被宣告死亡 17)其他特殊情形—自愿缴存期满 18)其他特殊情形—重复账户合并 19)未在异地缴存且封存满半年以上提取

Withdrawal of accumulation fund- Purchase an owner-occupied home with ownership

First, the purchase of owner-occupied housing with ownership (the date of issuance of the property certificate isBefore February 10, 2017)

Application Scope:

Individuals and their spouses who purchase owner-occupied housing with ownership, and do not have housing provident fund loans, and do not withdraw housing provident fund to repay loans entrusted。

Handling place:

Construction Bank housing provident fund business network or Shanghai provident fund management center business network。

Handling requirements:

1) Original identity documents: ① I provide identity documents ② entrusted: A trustee is the spouse of the principal or direct relatives need to provide identity documents of the principal and the trustee,Household registration books or marriage certificates, household registration certificates issued by public security organs, etc., can prove the relationship between the client and the trustee,Power of attorney issued by the Trustor B If the trustee is not the spouse or direct relatives of the trustor, the identity documents of the trustor and the trustee shall be provided,The letter of authorization notarized by the notary organ 2) The original of the reason proof materials: ① The purchase contract for the purchase of commercial housing and second-hand housing, and the full invoice for the purchase of second-hand housing (if the invoice cannot be provided for the purchase of second-hand housing),It is necessary to provide the deed tax payment certificate), the real estate title certificate of the purchased housing (including the original real estate title certificate) (within 5 years from the date of issuance), the withdrawal person and the buyerRelation proof ②购买公有住房且房款已付清的提供公有住房出售合同、购房全额发票、所购住房的房地产权证(发证之 日起5年内)、提取人与购房人的Relation proof ③购买公有住房产证前提取Housing accumulation fund的提供公有住房出售合同、Individual house purchase交款凭证(已加盖China Construction Bank业 务章或现金收讫章的用户联)、提取人与购房人的Relation proof ④动拆迁安置产权住房的提供房屋动拆迁安置协议书、超安置费用部分的发票或收据(安置费直接抵扣房 款的,The relocation unit shall provide a written proof of making up the difference), the real estate title certificate (including the original real estate title certificate) (within 5 years from the date of issuance), and the relationship between the extractor and the owner of the propertyHouse auction confirmation, invoice or receipt for purchase of auction house, real estate title certificate (including original real estate title certificate) (From the date of issuance5 years), the relationship between the drawer and the property owner proof 3) the city bank debit card in my name。(Recommended to bring a Class 1 bank account debit card)。

Handling process:

1)购买公住房产证前提取Housing accumulation fund的:Individuals provide essential materials——交款凭证指定收款银行所在地的China Construction Bank Housing accumulation fund业务网点办理; 2)购买其他房屋的:Individuals provide essential materials—— ①提取申请人Housing accumulation fund账户在单位的,Construction Bank housing provident fund business outlets to handle ② withdrawal of the applicant's housing provident fund account in the "Shanghai Provident Fund Management Center Housing provident fund centralized storage special account", "voluntary deposit special account",The business network of Shanghai Provident Fund Management Center applies for ③ multiple withdrawal applicants at the same time,As long as there is a withdrawal of the applicant's housing provident fund account in the "Shanghai Provident Fund Management Center Housing provident fund centralized sealed special account", "voluntary contribution to the special account",All are managed by Shanghai Provident FundManage the central business network

Second, the purchase of owner-occupied housing with ownership (the date of issuance of the property certificate isOn and after February 10, 2017)

Application Scope:

1) Individuals and their spouses who purchase owner-occupied housing owned by the city,And no housing provident fund loans,2) Individuals and their spouses who purchase owner-occupied houses with ownership in other provinces and cities,The place where the house is located is the domicile of the employee himself or his spouse or his immediate relatives,And no housing provident fund loans,No withdrawal of housing provident fund to return loans entrusted。

Handling place:

Construction Bank housing provident fund business network or Shanghai provident fund management center business network。

Handling requirements:

1) Original identity certificate and relationship certificate: 2) Original documents for the reason of extraction: 1) Purchase of the city's owner-occupied property house to provide a purchase contract, purchase of full invoice (purchase of second-hand housing can not provide invoices,Need to provide the deed tax payment certificate), the real estate title certificate of the purchased housing (including the original real estate title certificate) (within five years from the date of issuance) ② The purchase of self-occupied property housing in other provinces and cities to provide a purchase contract, the purchase of full invoices (the purchase of second-hand housing can not provide invoices,It is necessary to provide the deed tax payment certificate), the real estate title certificate of the purchased housing (including the original real estate title certificate) (within five years from the date of issuance), the household registration certificate (3) The housing provident fund before the purchase of the public housing title certificate to provide public housing sale contract, personal purchase payment certificate (has been stamped with the construction bank business seal or cash received seal)联) ④ Provision of housing relocation relocation agreement, invoice or receipt exceeding the relocation cost (relocation fee directly deducting the house payment),应由动拆迁单位提供补差的书面证明)、不动产权证(含原房地产权证)(From the date of issuance五年内) ⑤购买House auction confirmation, invoice or receipt for purchase of auction house, real estate title certificate (including original real estate title certificate)(发 证As of五年内) ⑥购买本市共有产权保障住房政府产权份额的提供购买政府产权份额协议、上海市共有产权保障住房政府产 权份额价款缴清证明、不动产权证(From the date of issuance5年内) 3)本人名下的本市银行借记卡。(A Class I bank account debit card is recommended) 4) Other relevant materials: If the city Provident Fund Center doubts the authenticity of the employee's withdrawal behavior during the extraction audit process, it may require the employee to further provide other effective certification materials 。

Handling process:

1, the purchase of public housing property certificate before the withdrawal of housing provident fund: individuals to provide essential materials - payment voucher designated recipient bank housing provident fund business network handling 2) Purchase of other houses: individuals to provide essential materials - ① extract the applicant's housing provident fund account in the unit,Construction Bank housing provident fund business outlets to handle ② withdrawal of the applicant's housing provident fund account in the "Shanghai Provident Fund Management Center Housing provident fund centralized storage special account", "voluntary deposit special account",The business network of Shanghai Provident Fund Management Center applies for ③ multiple withdrawal applicants at the same time,As long as there is a withdrawal of the applicant's housing provident fund account in the "Shanghai Provident Fund Management Center Housing provident fund centralized sealed special account", "voluntary contribution to the special account",All are managed by Shanghai Provident FundManage the central business network

Employee "Residence Permit application" handling guide

1. Registration of residence

Application conditions:

Persons who come to Shanghai from within the territory shall, in accordance with the relevant regulations of the State and this Municipality, complete residence registration at the community affairs acceptance service center of their current place of residence。

Handling place:

Community affairs reception service center of your current residence。

Application materials:

1) Fill in the "Residence Registration Information Form" 2) Provide a copy of the resident ID card or household registration book (check the original),And one of the following certificates of legal residence in Shanghai: ① living in the housing purchased by oneself or close relatives,Provide a copy of the corresponding real estate ownership certificate (check the original) ② living in the rental housing of oneself or close relatives,Provide a copy of the housing rental contract registration and record certificate issued by the housing management department (the original inspection) ③ living in the unit or school dormitory,Provide the dormitory certificate issued by the unit, school personnel or security department。 The term "close relatives" as mentioned in the preceding paragraph includes spouses, children, grandparents, maternal grandparents, grandchildren, grandchildren and siblings。Those who live in houses purchased or rented by their close relatives shall also provide the corresponding proof of kinship。

Warm reminder:

The validity period of residence registration is one year, after which a new application must be made If the residence registration information of the resident who has registered in Shanghai changes, he/she shall go through the information change procedures at the community affairs acceptance service center of his/her current residence. And in accordance with 2) The provisions of Article 2, provide relevant supporting materials。

2. Residence permit processing

Application conditions:

To leave the place of permanent residence registration and apply for residence registration in this city for at least six months, meet the conditions of lawful and stable employment, lawful and stable residence, and continuous study One of the domestic personnel to Shanghai。

Handling place:

Community affairs reception service center of your current residence。

Application materials:

1) Fill in the Application Form for Shanghai Residence Permit 2) Provide a copy of the resident ID card or household registration book (check the original) Where the current residential address of the applicant is inconsistent with the residence registration address, the applicant shall provide the corresponding residence certificate in accordance with the provisions of Article 2 of these Rules。

Information changes:

If the holder's residential address or other registration information in this municipality has changed, it shall be registered inWithin 30 days, bring the relevant certification materials to the community affairs reception service center of your current residence to go through the information change procedures。

Redemption and replacement:

If it is damaged and difficult to identify or lost, the holder shall promptly go to the community of his current place of residence with a valid identity certificate such as a resident ID card or household registration book Transaction reception service center for reclaiming and reclaiming procedures。If the certificate is lost, the loss can be reported at the same time

Residence Permit Endorsement:

Residence Permit is signed once a year The holder should be before the expiration of the "Residence Permit" endorsement periodWithin 30 days, go to the community affairs reception service center of your current place of residence to apply for endorsement, fill in the Application Form for Shanghai Residence Permit, and bring the holder of your Residence Permit who fails to sign within the time limit, the use of the Residence Permit will be suspended, and the use of the Residence Permit will resume after the application of the endorsement procedure。If the visa is reapplied within 60 days after the deadline, the residence permit holder's years of residence in this city shall be counted continuously from the date of reapplying the visa。If the visa application is made up 60 days after the expiration date, the residence permit holder's years of residence in this city shall be recalculated from the date of the visa application。

The Residence Permit has the following main functions:

1)作为《欧洲杯买球网》持有人(以下简称持证人)在本市居住的证明; 2)记录持证人基本情况、居住地变动情况等人口管理所需的相关信息;

Employee "Residence Permit Points Application" handling guide

Simulation score over120 points to apply for residence permit points:

http://jzzjf.rsj.sh.gov.cn/jzzjf/pingfen/index.jsp

Rules for handling residence permit points:

http://jzzjf.rsj.sh.gov.cn/jzzjf/pingfen/zc2.jsp

Change of residence permit points:

Talent center application unit change (the employer needs to be registered online and approved by the acceptance point)

Handling place:

The holder of the residence permit changes the work unit, from the employer to the district talent service where the unit is registered, the community or the private non-enterprise registration place Central management

Handling requirements:

1) The original and photocopy of the holder's ID card and residence permit 2) Provide the original and photocopy of the labor (employment) contract for more than one year during the contract period 3) the business license of the unit (registration certificate of the legal person of the institution, the certificate of the association or non-enterprise legal person) and the copy of the organization code certificate or the unified social credit code certificate 4) the original and photocopy of the previous unit's return form

2)

Warm reminder:

Procedures need to be completed within the validity period of the Shanghai Residence Permit points by the personnel specialist of the employer with the letter of introduction of the unit and the original ID card of the personnel specialist (retained for recovery Printed copies) to declare, other units and individuals can not declare

Residence permit and Residence Permit points Function use:

Employee "Account application" handling guide

At present, Shanghai is divided into the following situations, which need to apply through the unit, and the unit has been recorded in the talent, and employees need to meet at the same time Labor contract signing units, social security payment units and individual income tax payment units shall be consistent。

Transfer of residence:

Overseas returnees settle down:

Talent introduction:

Fresh graduates settle down:

The policy is updated every year, and those who settle down need to pay attention to the notice of non-Shanghai college graduates entering Shanghai for employment

Employee "Individual Income tax special deduction application" handling guide

The special deduction of individual tax meets the application conditions (7项)

Infant care expenditure:

For taking care of infants and young children under the age of 3, the standard deduction of 1000 yuan can be deducted by one parent at 100% of the standard deduction, or by both parents at 50% of the standard deduction。

Home Loan Interest expense:

1) Housing in China purchased by oneself or spouse;2) It is the first housing loan, and it is still paying the loan after deducting the year;3) Housing loan interest expenses and housing rent expenses are not deducted at the same time

Housing rent expenditure:

1) I and my spouse do not own a house in the main city of work;2) I and my spouse deduct the annual undeducted housing loan interest expenses;3) If the main working city of the spouse is the same, the spouse has not enjoyed the deduction of housing rent expenses in the deduction year

Continuing education expenditure:

Qualifications (degree) The qualifications for continuing education need to be deducted from the year of receiving educational qualifications (degree) in China。Continuing education for vocational qualifications is required In addition to the annual professional qualification or professional and technical personnel professional qualification certificate

Expenditures for supporting the elderly:

1) The dependant in the deduction year has reached the age of 60 (inclusive) (the dependant includes: ① parents;(2) The taxpayer is a non-only child,You can choose to share the support equally,Apportionment agreed by the dependants and apportionment designated by the dependants;If the contribution is agreed upon by the dependant or designated by the dependant,A written assessment agreement must be signed

Children's education expenditure:

Having children meets one of the following two conditions:① Deduction for full children in the year 3 years old and in the pre-primary stage;② Children are receiving full-time academic education in the deductible year。Note that the deduction ratio for the father and mother of the same child shall not exceed 100%

Medical expenses for serious diseases:

The medical expenses within the scope of the medical insurance list, and the personal out-of-pocket payment after medical insurance reimbursement;There is a personal burden over 15,000 yuan of drug expenses

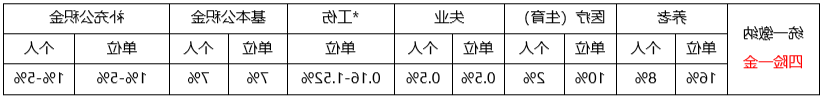

Individual income tax special additional deduction and deduction standard:

Employee "Tax receipt Issuance" handling guide

Tax form printing (Before January 1, 2019) Register with Shanghai Electronic Tax Bureau:http://etax.shanghai.chinatax.gov.cn/, select "I want to do taxes"➡Certification issue ➡Personal income tax list inquiry and application➡Select the date you want to query➡Download and print

Tax form printing (After 1 January 2019, Register with the Natural Person Electronic Tax Office (http://etax.chinatax.gov.cn/Complete the personal real name login➡Featured applications (currently required Must be accessed from this interface)➡Issuance of tax records➡Select the date you want to issue➡Download and print (the password to unlock the file is the last six digits of the ID card)

Leave regulations for employees

Annual Leave:

The number of annual leave days is determined according to the accumulated working hours of the employee。During the period when employees work in the same or different employing units, and in accordance with laws, administrative regulations or regulations of The State Council If it is deemed to be the working period, it shall be counted as the accumulated working time。The specific period of leave is: 1)职工累计工作已满 1年不满 10 年的,年休假 5天; 2)职工累计工作已满10年不满20年的,年休假 10天; 3)职工累计工作已满20年的,年休假15天。 National statutory holidays and rest days are not included in the annual holidays。The unit may also specify the number of annual leave days, allowing more than the statutory days but not less than the number of annual leave days stipulated by the state

产假:

Female workers enjoy basic maternity leave for 98 days after a single birth.In addition to the maternity leave stipulated by the state, you can also enjoy an additional 60 days maternity leave (incentive leave).。Prenatal leave of 15 days;If childbirth is difficult, the maternity leave shall be increased by 15 days;In case of multiple births, maternity leave shall be increased by 15 days for each additional birth。 Abortion leave: 15 days under 4 months;Over 4 months and 42 days。 Male workers: can take 10 days paternity leave, including weekends, in case of statutory holidays

事假:

Under what circumstances can the State ask for personal leave for enterprise employeesAs well as the issue of salary treatment for personal leave has not made uniform provisions, enterprises can formulate their own rules and regulations according to the specific situation。The rules and regulations formulated by enterprises in accordance with the law are binding as long as they do not violate the laws and regulations of the State。In practice, it is generally agreed between the enterprise and the employee in the labor contract on the matter of asking for personal leave, such as the maximum number of days per month for personal leave, otherwise it will be dismissed and other penalties。At the same time, if an employee asks for personal leave, the company will convert the corresponding deducted salary according to the actual working days of the employee

病假:

When an enterprise employee needs to stop working for medical treatment due to illness or non-work-related injury, he or she shall be given three months to two months according to his or her actual working years and working years in the unit Fourteen months of medical treatment。Sick pay requirements: During the treatment of an employee's illness or non-work-related injury, the employee shall be paid by the enterprise in accordance with relevant regulations during the prescribed medical treatment period Leave pay or sickness benefit, sick pay or sickness benefit may be paid below the local minimum wage standard, but not below the minimum wage standard 80% of employees due to illness or non-work-related injury continuous leave within 6 months, the enterprise shall pay sick pay according to the following standards: continuous service less than two years, according to 60% of the labor capital;For those who have worked continuously for two years but not more than four years, they shall be paid at 70% of their wages;Four consecutive years of service noSix years on my own salary80% distribution;For those who have continued to work for six years but not more than eight years, they shall be paid at 90% of their wages;An employee who has worked continuously for eight years or more and is paid at 100% of his or her salary for a continuous leave of more than six months due to illness or non-work-related injury,Enterprises shall pay sick pay according to the following standards: continuous service of less than 1 year,40% of my salary;Continuous service of not less than one year but not more than three years,Based on 50% of my salary;Continuous service of 3 years or more,Pay at 60% of my salary。

丧假:

Spouses and parents of employees(adoptive parents), children, immediate siblings death, the city can apply for 3 days of bereavement leave;Non-immediate family members are entitled to 1 bereavement leave。

婚假:

The legal marriage age shall not be earlier than 22 years old for men and 20 years old for women, and they may enjoy three days of marriage leave。Increased marriage leave in Shanghai: In addition to enjoying the marriage stipulated by the state, the marriage leave is increased by seven days。

Employee "Residence Permit unit change" handling guide

Community handling work unit information change

材料:

1) Residence permit

2) Application for change of Shanghai Residence Permit Information

3) Copy of the original labor contract

4)其他

* Agent: Employee himself

* Address: Residence community affairs reception Service center

Change of applicant of Talent Center (after community change)

材料:

1) Copy of original valid ID card and residence permit

2) Copy of the original labor contract

3) Copy of business license and organization code certificate

4) The original copy of the last employer's return slip

5) The personnel introduction letter of the unit, the copy of the original ID card

* Agent: unit personnel

* Address: the district (county) talent center where the employer is located

办理结果:信息变更后当场领取《<上海市Residence permit>积分通知书》,并同时更新Residence permit卡内信息

Employee "Residence Permit New Office" handling guide

材料:

1) Application Form for Residence Permit

2)照片

3) Copy of original identity certificate

4) Proof of residence in the city for more than 6 months

5) Provide a labor contract with a term of more than 6 months

6) Proof of participation in the municipal employee social insurance for at least 6 months

7) Other supporting materials

* Place of application: the residence permit acceptance network of the street of the residence, please refer to the following:

http://www.962222.net/pages/sbk/sbkfw.html

* Agent: Employee himself

Employee "Residence Permit points confirmation" handling guide

Handling agency

Acceptance point of talent service center in the district where the employer is registered

Service basis

1. Measures for the Administration of Residence Permit of Shanghai Municipality (Decree No. 2 of the Municipal Government)

2. "Shanghai Resident Permit Points Management Trial Measures" (Hufu Fa (2013) No. 40)

3. Implementation Rules of the Measures for the Management of Residence Permit Points in Shanghai (Shanghai People's Society Lifa (2015) No. 31)

Bidding conditions

Individual employee

1. The "Shanghai Residence Permit" has been signed at the community affairs reception service center of the residence

2. Social security payment units and labor contract signing units shall be consistent

3. The labor contract signed with the Shanghai company shall be more than 2 months from the date of application to the termination date of the contract

4. To dispatch employees, sign a contract with a dispatching intermediary company, and dispatch them to the Shanghai company or wholly foreign-owned representative office, the contract term must be at least one year, and more than 2 months from the termination date of the contract

Employee company

1. Registered in Shanghai

2. The reporting unit is a wholly foreign-owned representative office in Shanghai, which needs to be dispatched through an intermediary

Application materials

Basic materials (required)

1. Application Form for Shanghai Residence Permit Points

2. Residence permit

3. Identification card

If the information changes, provide corresponding materials

1. Household register or household registration certificate

2. Diploma, degree certificate

3. The qualification certificate of professional and technical positions obtained during the period of working in this Municipality, the letter of appointment of the unit, the professional and technical vocational qualification certificate, and the national vocational qualification certificate of skills

4. If the spouse is registered in this municipality, the marriage certificate, spouse ID card and spouse household register shall be provided

5. Materials required for tax investment or Local Employment credits:

① Capital verification report of the holder's investment enterprise in the city

② Industrial and commercial archives machine reading materials

③ Tax details of the city for the last three consecutive years

④ The list of employees of the city's household registration issued by the employer for the most recent 3 consecutive years (the employee's social insurance must be paid in the city for more than 6 months continuously)

⑤ Certificates of recognition and award from municipal organs such as Ministry, committee, office, bureau and above obtained by the holder during his/her work in the city (If the holder applies for bonus points for recognition awards, bonus points can be obtained after the organizer of recognition and award has filed with the Office of the Coordination Group of the Municipal Evaluation Standard Recognition work)

Family attache

配偶

1. Spouse non-resident household registration book (detailed address home page, personal information page) or collective account of origin information page

2. Marriage certificate

3. Identification card

Underage only child

1. Children's household register

2. Medical certificate of birth

3. One-child certificate

4. Certificate of enrollment and school status (16 years old or above)

5. Parents' marriage certificate

Minors are not only children

1. Children's household register

2. Medical certificate of birth

3. Birth permit, second child approval form

4. Parents' marriage certificate

5. Certificate of enrollment and school status (16 years old or above)

Note: If an attache is added, it is also necessary to provide the principal witness residence permit and ID card

Service procedure

1. Employers must first register online (http://jzzjf.12333sh.gov.cn/jzzjf/)

2. The personnel of the employer shall present his ID card, letter of introduction, business license, organization code certificate (check the original) and code card to the talent service center of the district where the employer is registered for unit audit

3. After the completion of the audit, the employer or employee logs in to the Internet for online registration and information filling, and the employer reviews the personal information

4. The personnel of the employer shall submit the relevant declaration materials to the talent service center of the district where the employer is registered with the ID card and the letter of introduction

5. After the approval, the personnel of the employer will go to the talent center of the acceptance point to receive the "Point Notice".

Deadline for handling

After the files arrive and the materials are officially accepted, the results will be approved within 20 working days

其他

Related website: http://jzzjf.12333sh.gov.cn/jzzjf/

If in doubt, please contact customer service at 400 630 6666

Employee "Residence Permit Points Application" handling guide

Handling agency

Acceptance point of talent service center in the district where the employer is registered

Service basis

1. Measures for the Administration of Residence Permit of Shanghai Municipality (Decree No. 2 of the Municipal Government)

2. "Shanghai Resident Permit Points Management Trial Measures" (Hufu Fa (2013) No. 40)

3. Implementation Rules of the Measures for the Management of Residence Permit Points in Shanghai (Shanghai People's Society Lifa (2015) No. 31)

Bidding conditions

Individual employee

1. Have obtained the "Shanghai Residence Permit" and the simulation score reaches the standard score of 120 points

2. Social security payment units and labor contract signing units shall be consistent

3. The term of the labor contract signed with the Shanghai company must be at least one year, and the termination date of the contract must be more than six months

4. To dispatch employees, sign a contract with a dispatching intermediary company, and dispatch them to the Shanghai company or wholly foreign-owned representative office, the contract term must be at least one year, and the termination date of the contract must be more than six months

Employee company

1. Registered in Shanghai